A surge in wheat and corn prices is boosting demand for low-grade rice in animal rations across Asia, pushing up prices of the world’s most important staple at a time when global food inflation is already hovering near record highs, Naveen Thukral reported for Reuters.

Global crop importers are scrambling for supplies after Russia’s invasion of Ukraine severed grain shipments from the two countries, which together account for around 25% of world wheat and 16% of world corn exports.

Chicago wheat futures hit a record high last week while corn climbed to its highest in a decade after war-torn Ukraine shut its ports and Western sanctions hit Russian exports.

The price spikes in wheat and corn, in turn, pushed buyers to seek alternatives, including in China, by far the world’s largest feed market. Importers there are in talks to buy extra volumes of broken rice - inferior rice where the grains have been fractured during the milling process - to fatten hogs and other animals, traders and analysts said.

Rice typically trades at a steep premium to wheat, but wheat’s blistering 50% price surge from a month ago has sharply cut the difference between the two grains, and even made wheat more expensive than some lower grades of rice.

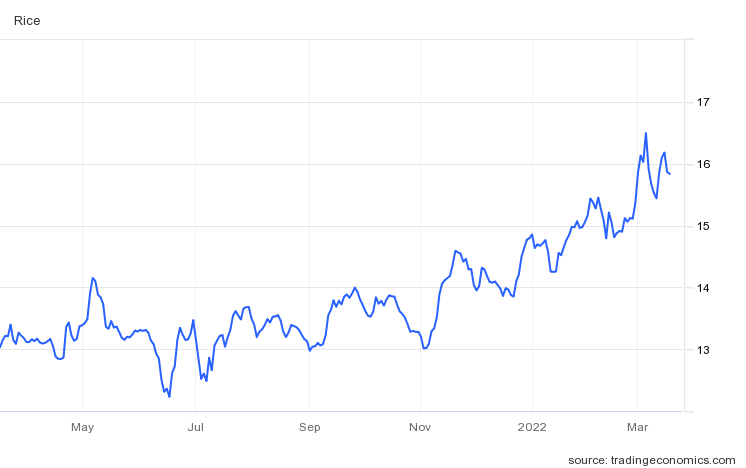

Benchmark food-grade rice from Thai exporters made its biggest weekly gain since October 2020 last week on the back of firmer food and feed demand, climbing 5% to around $421.50 a ton.

That’s the highest since last June, and sources say prices may keep rising if the disruption to Black Sea flows persists. Export prices from Vietnam and India have also climbed.

“There could be greater interest in broken rice for animal feed if the strength currently dominating wheat and corn markets persists,” said Rome-based FAO rice economist Shirley Mustafa.

“It is not just animal feed, there could also be a substitution in other use sectors, such as more people turning to rice for their meals.”

China had booked up to two million tons of Ukrainian corn imports for this year, but most of those shipments are now in jeopardy given the disruption to Ukraine’s logistics chains. To replace those lost volumes, China is expected to import three million tons of broken rice, up from about two million tons annually in the past two years, said a Beijing rice trader.

One importer in Guangdong is looking to buy broken rice from Thailand, while others have recently bought Indian broken rice for feed, according to another source briefed on the matter.

“Demand for Indian broken rice has gone up because of higher corn prices. Feed makers are trying to replace corn with rice,” B.V. Krishna Rao, president of India’s Rice Exporters Association, told Reuters.