More than $9 billion dollars was invested in agrifoodtech ventures in Europe in 2021, according to the latest European AgriFoodTech Investment report from AgFunder in collaboration with F&A Next. [Disclosure: AgFunder is AFN’s parent company.]

But that big headline number begs the question: are investors backing the right things?

We are eight years out from the Paris climate accord deadline for preventing catastrophic global warming and climate change. Trillions of dollars in investment are needed annually to achieve Paris’ ambitious goals. Last year, just $630 billion was invested in climate change mitigation and adaptation worldwide.

In Europe, just $1.5 billion, or 16%, of agrifoodtech investment capital went into technologies that could potentially have a high impact on the food system’s climate footprint, according to new research undertaken by AgFunder in collaboration with Dutch state investor Invest-NL.

Given the agrifood systems’ contribution to global greenhouse gas emissions globally (around one-third depending on the citation), this small sum of climate-forward capital seems like nothing but a missed opportunity.

Where did the money go?

Similar to the global agrifoodtech scene, investors mostly backed online grocery ventures and other asset-light downstream technologies. European e-Grocery startups raised $4.2 billion, representing 43% of Europe’s total agrifoodtech investment capital and a 1,300% year-over-year jump.

Three instant delivery companies raised 73% of all e-Grocery funding and 32% of total funding in Europe: Germany’s Flink and Gorillas, and the Netherlands’ Picnic.

There are signs of trouble in the online grocery sector, however, raising questions as to whether such services will be sticky with consumers long-term. Berlin-based Gorillas, which operates in Germany and other EU markets as well as the US and UK, announced that it was laying off 300 workers. The UK’s Zapp is considering similar cuts to its workforce.

Mega-deals in the e-grocery sector in Europe and elsewhere “took place in a more optimistic investment environment than the companies face now,” AFN’s Jenn Marston and Louisa Burwood-Taylor wrote in a recent analysis of the sector. “Steeply rising inflation, continued supply chain issues exacerbated by the war in Ukraine, and an end to the pandemic are among the drivers of the tech downturn” affecting companies that were good bets for investors during prolonged Covid-19 lockdowns.

Instant grocery delivery’s future looks murky as Getir, Gorillas & Zapp announce cuts

Climate-smart European agrifoodtech

When the global economy slowed in early 2020, we witnessed a flight of capital into upstream agrifood technologies: Innovative Foods, Farm Robotics & Machinery, Novel Farming Systems and Ag Biotechnologies. Investors looking at where to bet their money in a murky economic environment opted for technologies that required longer-term investment. Most of these were on the “upstream” side of the market, where technologies most closely impact how food is produced, rather than when and how it’s consumed.

The upstream side of the market also happens to be where the greatest positive climate impact potential of agrifoodtech can be found. Solutions for soil carbon management, production and use of biochar, and livestock and nutrient management are a few of the most impactful investment opportunities in the sector, according to the latest report from the Intergovernmental Panel on Climate Change.

Also of great significance: the shift to sustainable healthy diets, including more plant-based diets, and reducing food waste across the agrifood value chain.

In partnership with Invest-NL, AgFunder mapped our investment data to the agrifoodtech sectors addressing these issues. Most investments in certain upstream sectors, such as Novel Farming Systems, Innovative Foods, and Farm Robotics and Mechanization, are effectively “climate tech” investments.

Nearly all of Europe’s funded Novel Farming startups, for instance, are working to develop environmentally-friendly growing systems, including Germany’s vertical farming startup Infarm, UK’s Intelligent Growth Solutions, and French insect farming venture Agronutris.

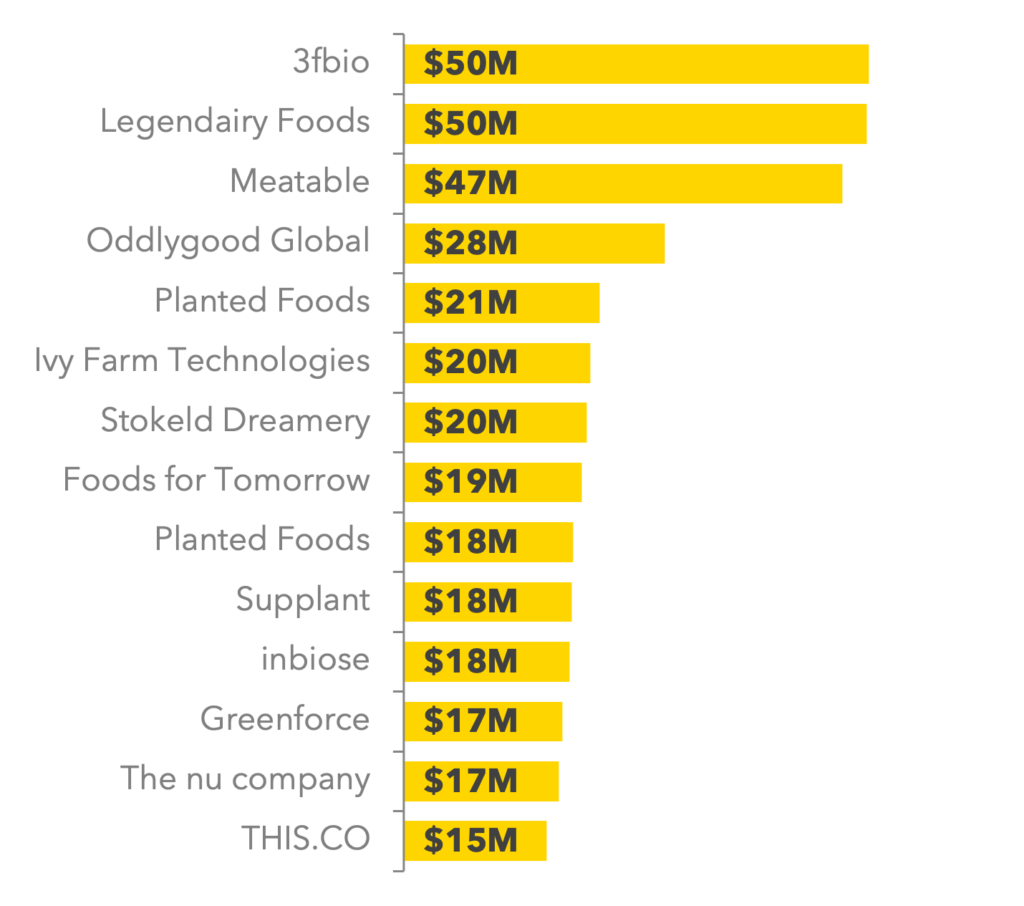

In the Innovative Foods category, 93% of investments were climate impact-aligned, including UK-based fermentation tech startup 3fbio, German alt-dairy producer Legendairy Foods, and Dutch cultivated meat company Meatable.

On the downstream side, where two-thirds of European agrifood investment capital flowed, opportunities for climate impact are significantly lower.

In the e-Grocery category, for example, just 17% of funding went to startups whose business models have a deliberate, positive climate impact. The overwhelming majority of that capital went to Picnic in the Netherlands, which uses an all-electric delivery fleet and pledges zero-waste. Yet its core business model is not designed for climate impact. The Gates Foundation clearly sees the potential for positive impact, however, as it led the company’s $707 million round last year.

More impactful: e-Grocers that have designed purchasing and subscription models around surplus foods, “ugly produce,” and other foods that would otherwise be wasted. These niche businesses captured just a small share of European agrifood investment capital.

Calculating impact

It’s true that the actual climate impact of many of these startups is not yet known; most are not yet in the market or are too new to market to accurately calculate their environmental impact. But getting to the point where we’re better able to determine which technologies have the greatest potential in the market first requires investors who understand the stakes and opportunities.

“It is often the case that many of these innovative solutions are perceived as risky and have difficulty attracting funding to scale their businesses,” writes the Invest-NL team in the report addendum. “Patient capital is needed to push these innovations forward.”

This is the first time AgFunder has analyzed our agrifoodtech investment data with a climate impact lens. We aim to broaden and refine our climate investment filters for other regions, and globally, over time. Get in touch if you’d like to learn more at jessica@agfunder.com.