As the calendar turns to 2022, the world has been living under the pandemic’s shadow for more than two years now. Across the whole of the globe, there are worker shortages, product shortages, and rising prices being seen in many, many segments of the economy.

For agriculture, however, things are troubling as well. However, based upon the data provided by the 8th annual CropLife Buying Intentions Survey, most of the nation’s ag retailers are anticipating a busy buying season ahead of them. Let us review the major segments of the business to see how each might end up once the dust settles on the 2022 growing season.

The Equipment Outlook

The Equipment Outlook

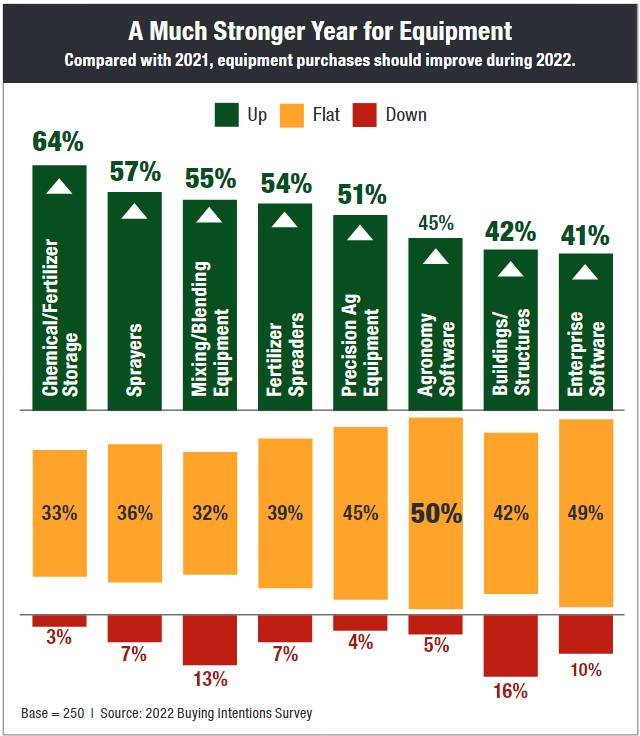

During 2021, the equipment category looked to have a slow year. Due in part to the ongoing pandemic and depressed in-person events perhaps, only one-quarter of the nation’s ag retailers planned to spend more on equipment in 2021 than they did in 2020.

Luckily, it appears that 2022 will be a much stronger season for equipment spending. According to the 2022 Buying Intentions Survey, more than half of respondents intend to up their spending on equipment purchases this year in five of the eight sectors that make up this segment. Leading the charge will be chemical/fertilizer shortage products, with 64% of respondents planning to spend between 1% and 11% more than they did during the 2021 growing season. Other sectors expected to see marked improvements include self-propelled sprayers, with 57% of respondents planning to spend more in 2022, mixing/blending equipment, with 55% intending to up their spending in this sector, and fertilizer spreaders, where 54% of respondents will spend between 1% and 11% more in 2022. Precision agriculture equipment also will see an improvement from 2021, with 51% of respondents intending to spend more in this area.

The Fertilizer Outlook

The Fertilizer Outlook

Throughout the 2021 growing season, the fertilizer category experienced unprecedented price increases. In fact, as the fall application season began, fertilizer prices overall had tripled in many sectors. For example, growers were paying between $300 and $400 per ton for anhydrous ammonia during the fall of 2020. One year later in 2021, however, the average price for a ton of anhydrous ammonia had increased to between $1,000 and $1,200!

Add to this the fact that the fertilizer segment didn’t perform as strongly during 2021 among ag retailers as it did during 2020. Indeed, according to the 2021 Buying Intentions Survey, three fertilizer categories — dry fertilizer, liquid fertilizer, and micronutrients — saw increased spending from the ag retail sector. However, the rest — specialty fertilizers, nitrogen/phosphorus stabilizers, and additives/enhancers — recorded flat revenues or outright sales declines in 2021.

Given these facts, it would only be natural for market watchers to predict the fertilizer segment would again experience a mixed bag when it come to buying intentions for the 2022 growing season, or perhaps see decreased sales across the board.

But this doesn’t appear to be the case.

According to 2022 Buying Intentions Survey, all six fertilizer segments should be in high demand from ag retailers. In fact, the percentage of respondents saying they plan to increase their spending between 1% and 11% more in these segments tops more than 60% for five of the six sectors. Leading the way as usual is the dry fertilizer sector, where 67% of survey respondents plan to increase their spending in 2022 between 1% and 11% more. Close behind is the liquid fertilizer sector, with a 66% mark. Also topping the 60% figure are additives/enhancers (63%), micronutrients and nitrogen/phosphorus stabilizers (at 62% apiece).

The only fertilizer sector not topping 60% is specialty fertilizers. But just by a hair! According to the survey, 59% of respondents plan to increase their buying in this sector between 1% and 11% more.

So, despite higher prices, the nation’s ag retailers are looking for more fertilizer sales in their operations for the 2022 growing season.

The Crop Protection Products Outlook

The Crop Protection Products Outlook

Like fertilizer, there has been plenty of worry regarding the overall state of the crop protection products marketplace. As supply chain disruptions have gripped much of the nation, getting many popular crop protection products such as glyphosate and glufosinate has become more difficult — and much more expensive. A few natural disasters, such as Hurricane Ida shutting down Bayer’s large glyphosate manufacturing facility in Louisiana for a few months, hasn’t helped the situation either.

But none of this has apparently dampened the agricultural industry’s appetite for crop protection items for the 2022 growing season. In fact, according to the 2022 Buying Intentions Survey, crop protection looks to be the strongest segment when it comes to intended purchases. Indeed, all seven sectors are expected to see sales increases between 1% and 11% more from more than half of the nation’s ag retailers. Better still, the percentage of ag retailers planning to spend less on these sectors is extremely small compared with other segments, ranging from 2% to 8%.

Leading the way for the crop protection products segment in buying intentions are two long-time standbys — herbicides and fungicides. Overall, according to the 2022 survey, 78% of respondents intend to buy between 1% and 11% more herbicides this year vs. than in 2021. For fungicides, the percentage expecting to spend more on the sector is 70%.

Two other long-time sectors — insecticides and adjuvants — also can expect strong buying during the 2022 growing season, according to the survey. In fact, the percentage of ag retailers planning to up their spending between 1% and 11% more in 2022 stands at 62% for both sectors.

Two newer sectors — biostimulants and biologicals — are also looking for stronger sales demand during 2022. According to the 2022 Buying Intentions Survey, 61% of respondents expect to increase their spending between 1% and 11% more on biological products this year. For biostimulants, the percentage planning to spend more in 2022 is 61%.

The only crop protection products sector not topping the 60% mark on the 2022 survey is seed treatment. Still, according to the survey respondents, 57% are looking to spend more on this sector in 2022, with another 41% saying they will spend “the same amount�? on seed treatment this year as they did during 2021. Only 2% are intending to spend between 1% and 11% less than they did during 2021.

The Seed Outlook

The Seed Outlook

With lots of uncertainty regarding fertilizer and crop protection product prices and supply hanging over the industry going into the 2022 growing season, most market watchers are still expecting the crop mix among growers to remain constant from 2021, with corn acres outpacing soybean by the same amount it has the past few years.

However, according to the 2022 Buying Intentions Survey, the nation’s ag retailers aren’t viewing the agricultural demand for seed in quite the same manner. In fact, 73% of survey respondents are intending to increase their soybean seed purchases for 2022 between 1% and 11% more. Only 5% plan to spend less in this sector.

Now to be fair, corn seed buying intentions are also up — with 60% of respondents to the survey planning to spend between 1% and 11% more on these kinds of seeds for 2022. Still, 17% of respondents expect to decrease their spending on corn seed for the year.

0

1

5

Buying Intentions Survey: What Product Categories are Ag Retailers Counting on in 2022?

Source link